NayaPay raised $13 million for its messaging and payment app

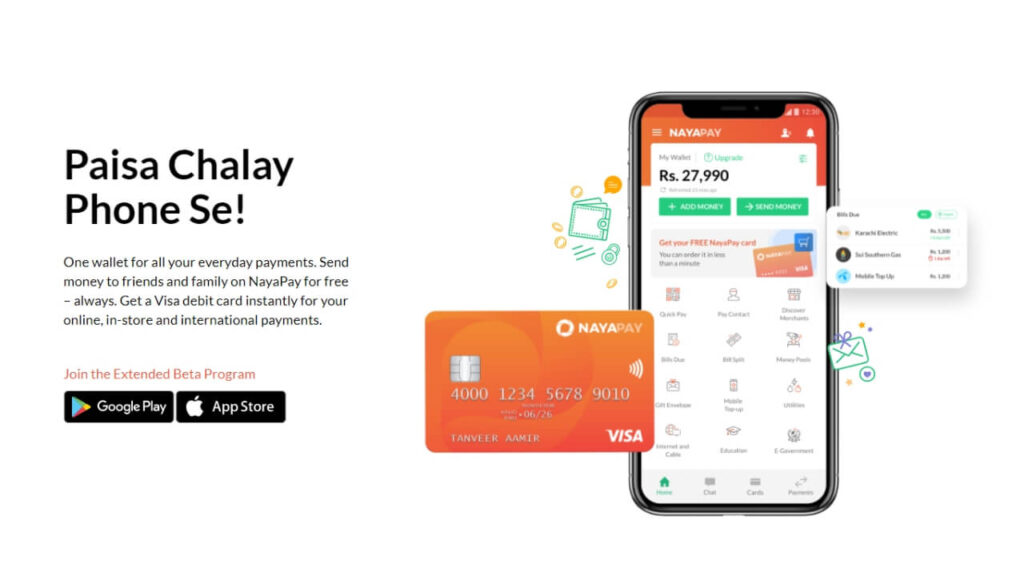

Pakistan’s NayaPay has raised $13 million to roll out its multi-service messaging and payment app. The platform allows users to send and receive money, split bills, and make payments conveniently from smartphones. They have also issued virtual & physical cards linked to the NayaPay wallet further allowing users to make payments.

It’s a digital payment platform, that is bringing a payment revolution to Pakistan, where only 1% of $4 trillion payments are done electronically. But the startup’s goal is to bank millions of adults that remain unbanked in Pakistan, with women affected the most. Only one in three women holds a bank account. In addition, only 1% of the population is digitally banked. NayaPay has also signed up over 200,000 users in less than two years.

They have launched a new app that lets you chat with businesses and pay them. The app is designed by keeping in mind students and small-business owners. And the company plans to launch a SaaS-based platform that will help business owners process payments, manage customer relationships, and more. This new system, which is similar to those offered by Square, AliPay, and WeChat Pay, will be available to all small merchants.

What it’s the Co-Founder says?

Co-Founder and Managing Partner, Faisal Aftab said “We’re very bullish on fintech in Pakistan. While just beginning to emerge, Pakistani fintech has the advantage of learning from peers and placing better informed strategic bets”

He also added “The founder & CEO of the firm has a great track record of establishing impressive businesses, country’s largest fiber broadband service “StormFiber” is one of them (StormFiber: it’s a subsidiary of Cybernet)”

How Faizan Lakhani decided to to launch NayaPay?

Danish Lakhani, NayaPay’s founder, and CEO came up with the idea for NayaPay while on business trips to China. In China, payment apps like WeChat Pay and AliPay are commonly used because they’re easy to use, quick, and secure. Lakhani decided to replicate this model in Pakistan and create NayaPay. He says it will revolutionize the payments space in Pakistan.

What it’s the CEO & Founder say?

Danish A Lakhani said: “Small businesses are the backbone of Pakistan’s economy. Yet, they are without basic financial services. NayaPay Arc is designed to provide universal payments acceptance and business finance tools to enable local entrepreneurs. The tools will enable them to focus on growth while we take care of the rest. We believe that by empowering local businesses, we can transform Pakistan’s economy.”

When it comes to customer trust, Danish A Lakhani has a major point. NayaPay Arc, and its client service team, deliver a unique, efficient experience for customers and businesses. In the near future, NayaPay will partner with banks to provide a fully digital banking experience.

It is the first fintech in Pakistan, and it recently secured the first E-Money Institution license from the central bank. This makes NayaPay a frontrunner in Pakistan’s financial services sector. Not only does it want to be at the forefront of digitalization, but it also wants to improve the lives of Pakistani citizens who are underserved by traditional banks.

Some of the NayaPay’s Features are as follow:

- No hidden charges, no annual fees and no SMS fee

- It’s globally accepted

- Offering physical & virtual cards

- Will splits bills among friends & will ask them to pay

- Send voice messages, Photos, and stickers

- Send Gift Envelopes with family & friends

- Reminders for upcoming bill payments

- Pay your mobile, utilities, clubs, schools, internet, travel and other everyday bills